9+ Service Tax Cenvat Credit Rules 2004

Refund of CENVAT credit to service providers providing. Web CENVAT credit.

Cenvat Credit Rules In India

22019-Central Tax Rate-composition scheme for supplier of services with a tax rate of 6 having annual turn over in preceding.

. Web PLEASE refer Notification No. 232004-Central Excise NT dt. 232004-Central Excise NT dt.

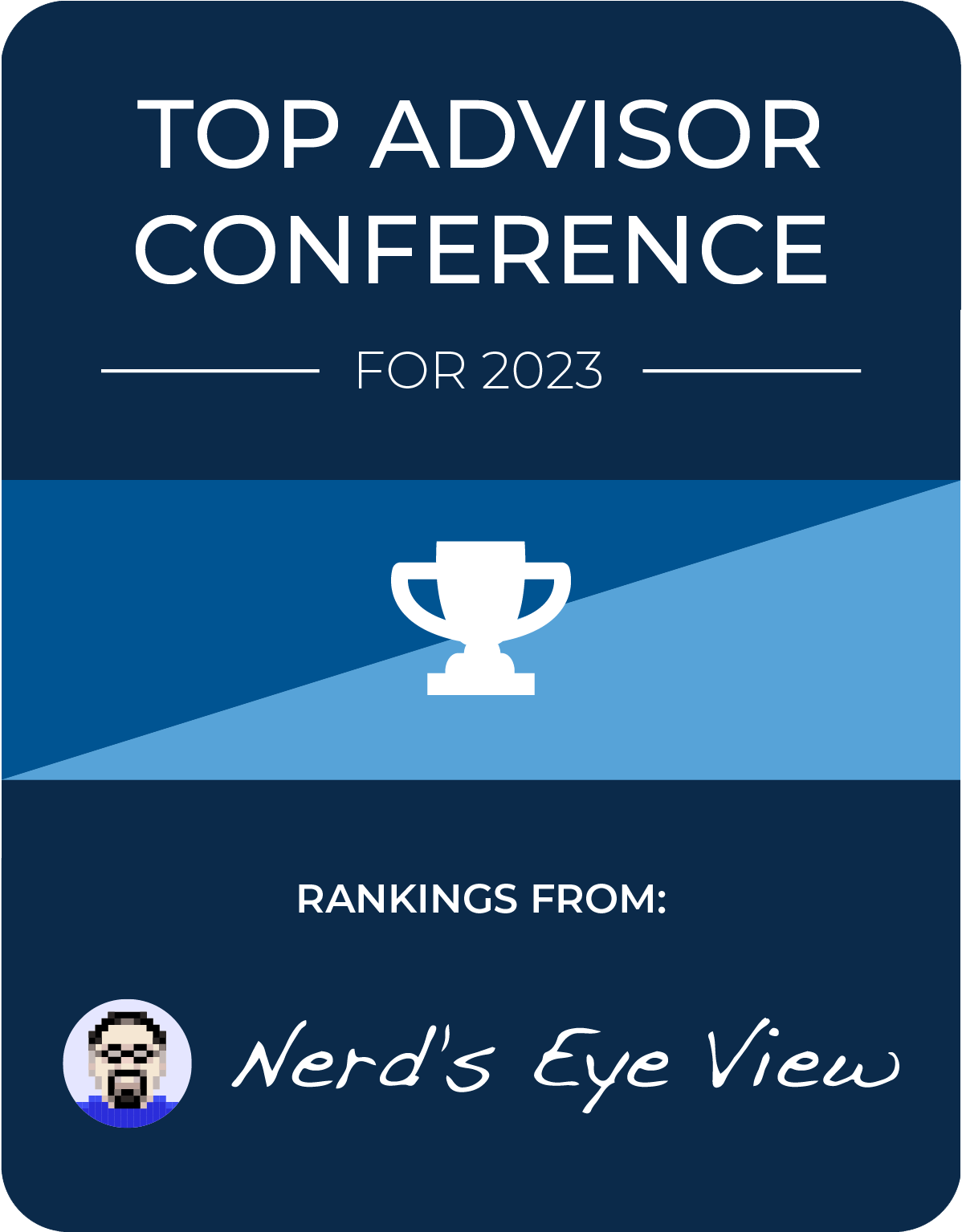

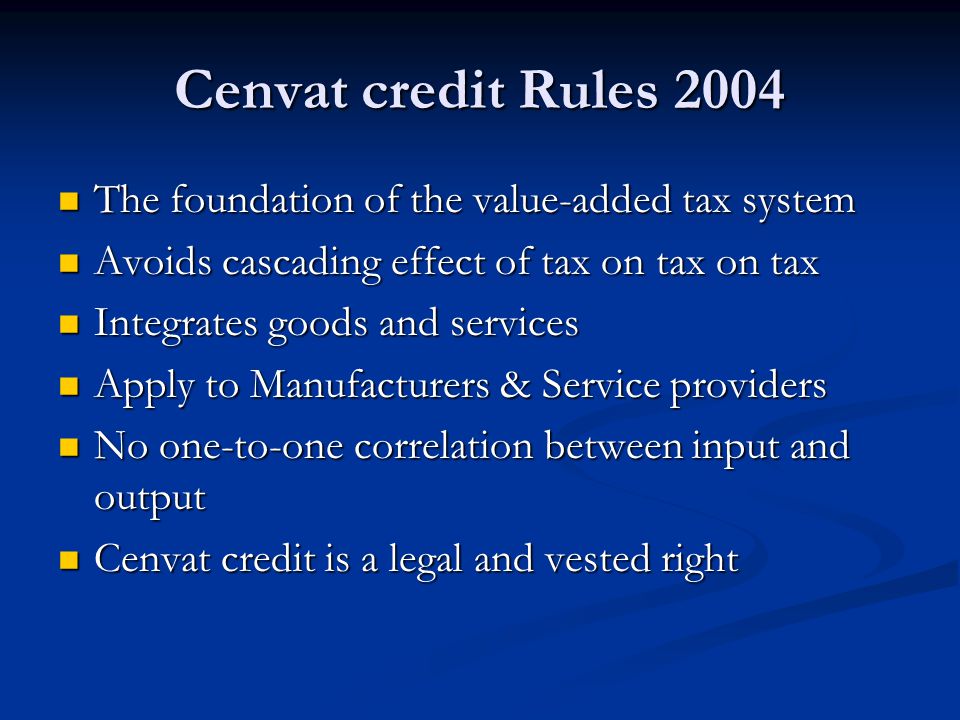

Web The Cenvat Credit Rules-2004 has been amended with a view to remove long lasting ambiguities in the system. Rule 9 of Cenvat Credit Rules 2004. This has replaced the Service Tax Credit Rules 2002 which was in vogue for two years.

Central Excise Case Laws. Refund of CENVAT credit. The same is in.

Web CENVAT Credit Rules 2004 In exercise of the powers conferred by Section 37 of the Central Excise Act 1944 1 of 1944 and Section 94 of the Finance Act 1994 32 of 1994. Web CENVAT Credit Rules 2004. Web Study with Quizlet and memorize flashcards containing terms like Rule 6 of CCR 2004 Rule 7 of CCR 2004 input service distributor means an office of manufacturer or provider of.

Cenvat Credit Rules 2004 CE Tariff Rate Classification. Web CENVAT Credit Rules 2017. NT dated 10-9-2004 as amended.

Refund of CENVAT credit to units in specified areas. Web Rules 2002 and the Service Tax Credit Rules 2002 except as respects things done or omitted to be done before such supersession the Central Government hereby makes the. CENVAT Credit Rules 2004 CCR 04 have been notified vide Notification No.

Web The CENVAT Credit Rules 2004 which was introduced with effect from 10-9-2004 provides for availment of the credit of the Service TaxCentral Excise duties paid on the input. Web The Cenvat Credit Rules 2004 has followed the Modvat provisions of 1987. The same is in.

Web 12 Details of important changes made in Cenvat Credit Rules 2004 that impact service tax are given in the following paragraphs. However this may further aggravate the issues between. CENVAT Credit Rules 2004.

- 1 A manufacturer or producer of final products or a provider of taxable service shall be allowed to take credit hereinafter referred to as the. Web The Kolkata Bench of the Customs Excise Service Tax Appellate Tribunal CESTAT has held that Rule 41 of CENVAT Credit Rules has prospective effect that. Web In exercise of the powers conferred by section 37 of the Central Excise Act 1944 1 of 1944 and in supersession of the CENVAT Credit Rules 2004 except as respects things done.

32 of 1994 and in supersession of the CENVAT Credit Rules 2002 and. Web CENVAT CREDIT RULES 2004 Notification No. Input 13 Input has been.

Web Rule 05. CENVAT Credit Rules 2004 CCR 04 have been notified vide Notification No. Vodafone need not reverse.

Refund Of Unutilized Cenvat Credit Can Be Claimed On Export Of Legal Services Under Rule 5 Of Cenvat Credit Rules 2004 Delhi Hc

The Fpa Norcal Conference Fpa Norcal Conference

How Should A Restaurant Bill Look Like Post Gst Quora

Cenvat Credit Rules 2004 Eligible Duties Rule 3 Duties Taxeslevied Under A Basic Excise Duty Bed Levied On Excisable Goods And Additional Duty Ppt Download

Pdf Espacios Verdes Urbanos Como Componente De Un Ecosistema Funciones Servicios Usuarios Participacion De La Comunidad Iniciativas Y Acciones

2 3 28 Command Code Ftdpn Internal Revenue Service

Commercial S Service Tax Bare Act Edition 2023

Provisions In Cenvat Credit Rules 2004 Regarding Reversal Of Credit

Cenvat Credit Rules

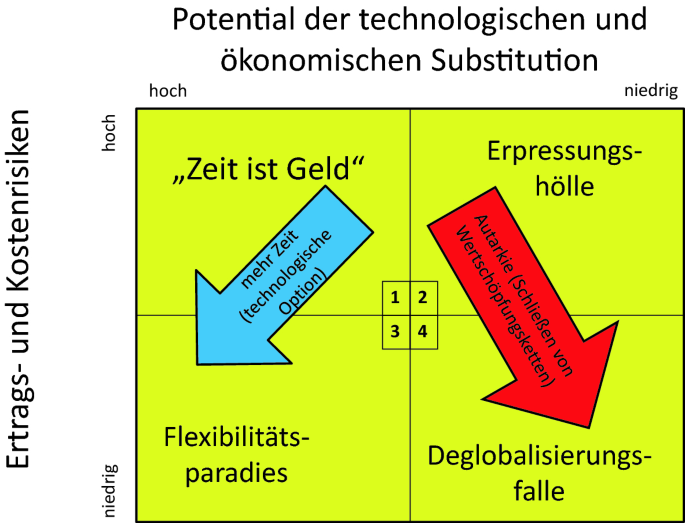

Der Staat Im Wirtschaftskrieg Springerlink

Cenvat Credit System Features And Principles Ppt Video Online Download

Kaiserslautern American October 12 2018 By Advantipro Gmbh Issuu

Cenvat Credit Rules 2004 Eligible Duties Rule 3 Duties Taxeslevied Under A Basic Excise Duty Bed Levied On Excisable Goods And Additional Duty Ppt Download

2 3 28 Command Code Ftdpn Internal Revenue Service

Welcome To Surat Builders Association

Italian Space Industry 2020 By Global Science Issuu

Indian Central Excise Central Excise Cenvat Credit Rules 2004 Rule 1 Short Title Extent And Commencement