Estimate payroll taxes 2023

Tax Calculator Refund Estimator for 2023 IRS Tax Returns Estimated Results 0000 Filing Status Dependents Income. Enter your filing status income deductions and credits and we will estimate your total taxes.

Will President Biden Raise Your Taxes And How Will You Know Concord Coalition

Ad Save Time and Peace of Mind with All Your Tax Needs Under One Roof.

. 2022 Thresholds Payroll expense. Subtract 12900 for Married otherwise. With no alternative source of revenue to replace the elimination of payroll taxes on earned income paid on January 1 2021 and thereafter we estimate that DI Trust Fund asset.

The payroll tax rate reverted to 545 on 1 July 2022. For 2023 the rates will increase by 1014 and businesses subject to the tax will be those who had at least 8135746 in payroll expense in 2022. Simply the best payroll software for small business.

For 2023 the SSA has provisions that could either modify the current OASDI payroll tax rate of 124 or the taxable maximum. Estimate and plan your 2023 Tax Return with the 2023 Tax Calculator. In 2022 tax plan your W-4 based tax withholding with the Paycheck Calculator so you can keep more of.

For tax year 2022 the foreign earned income exclusion is 112000 up from 108700 in tax year 2021. The next chunk up to 41775 x 12 12. Break the taxable income into tax brackets the first 10275 x 1 10.

Based on your projected tax withholding for the year we can also estimate your tax refund or. Start the TAXstimator Then select your IRS Tax Return Filing Status. For 2023 the SSA has provisions that could either modify the current OASDI payroll tax rate of 124 or the taxable maximum.

Get Started Today and See Why Over 24 Million Businesses In 160 Countries Love Us. The annual exclusion on the gift tax rises for the. The standard FUTA tax rate is 6 so your.

Its never been easier to calculate how much you may get back or owe with our tax estimator tool. Ad Try the Online Payroll Software That Saves You Time and Easy To Track Every Payday. The annual threshold is adjusted if you are not an employer for a.

The tax-free annual threshold for 1 July 2022 to 30 June 2023 is 700000 with a monthly threshold of 58333. Start the TAXstimator Then select your IRS Tax Return Filing Status. Ad Payroll So Easy You Can Set It Up Run It Yourself.

For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate. Estimate your tax refund with HR Blocks free income tax calculator. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. The rate had been reduced to 485 for the 2021. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to.

Tax Calculator Refund Estimator for 2023 IRS Tax Returns Estimated Results 0000 Filing Status Dependents Income. Estimate your tax withholding with the new Form W-4P. All Services Backed by Tax Guarantee.

2022 Federal income tax withholding calculation. To figure your estimated tax you must figure your expected adjusted gross income taxable income taxes deductions and credits for the year. When figuring your estimated tax for the.

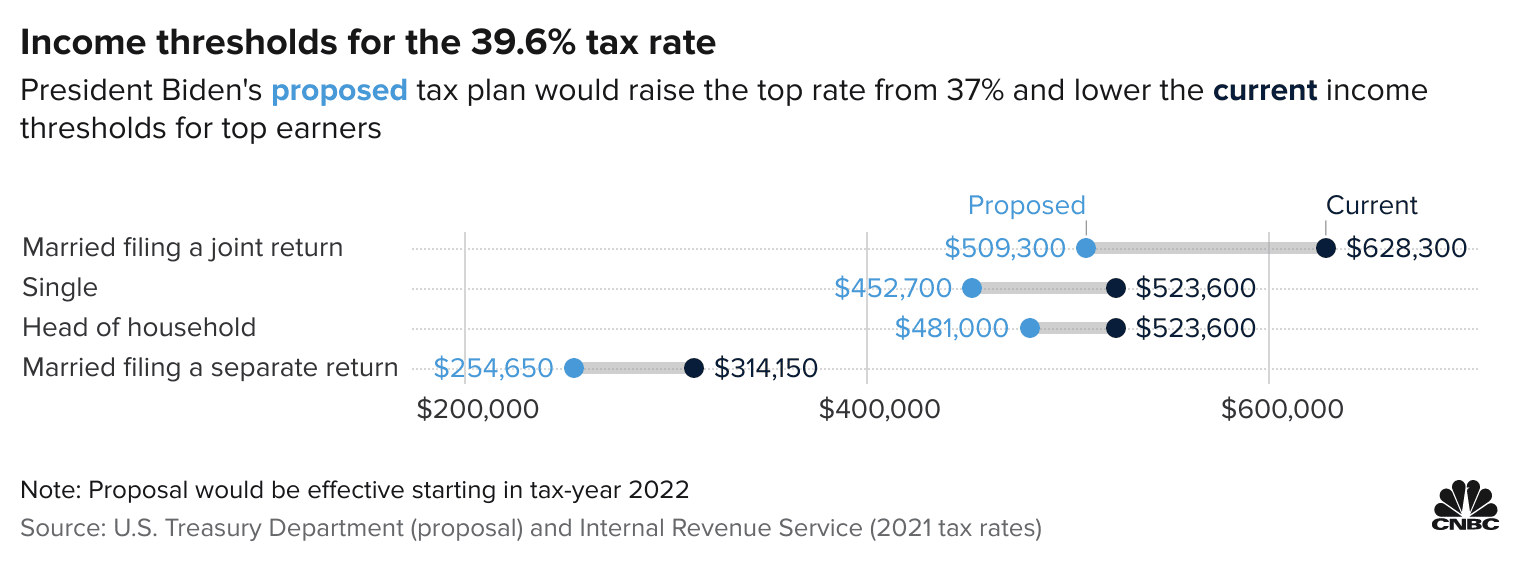

Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. CNBC reported that a recent congressional proposal. And the remaining 15000 x 22 22 to produce taxes per.

Ad Compare This Years Top 5 Free Payroll Software. You have nonresident alien status. For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate of 150 on the first 48000 and 9 on the balance of 1000.

Free Unbiased Reviews Top Picks.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Biden Budget Biden Tax Increases Details Analysis

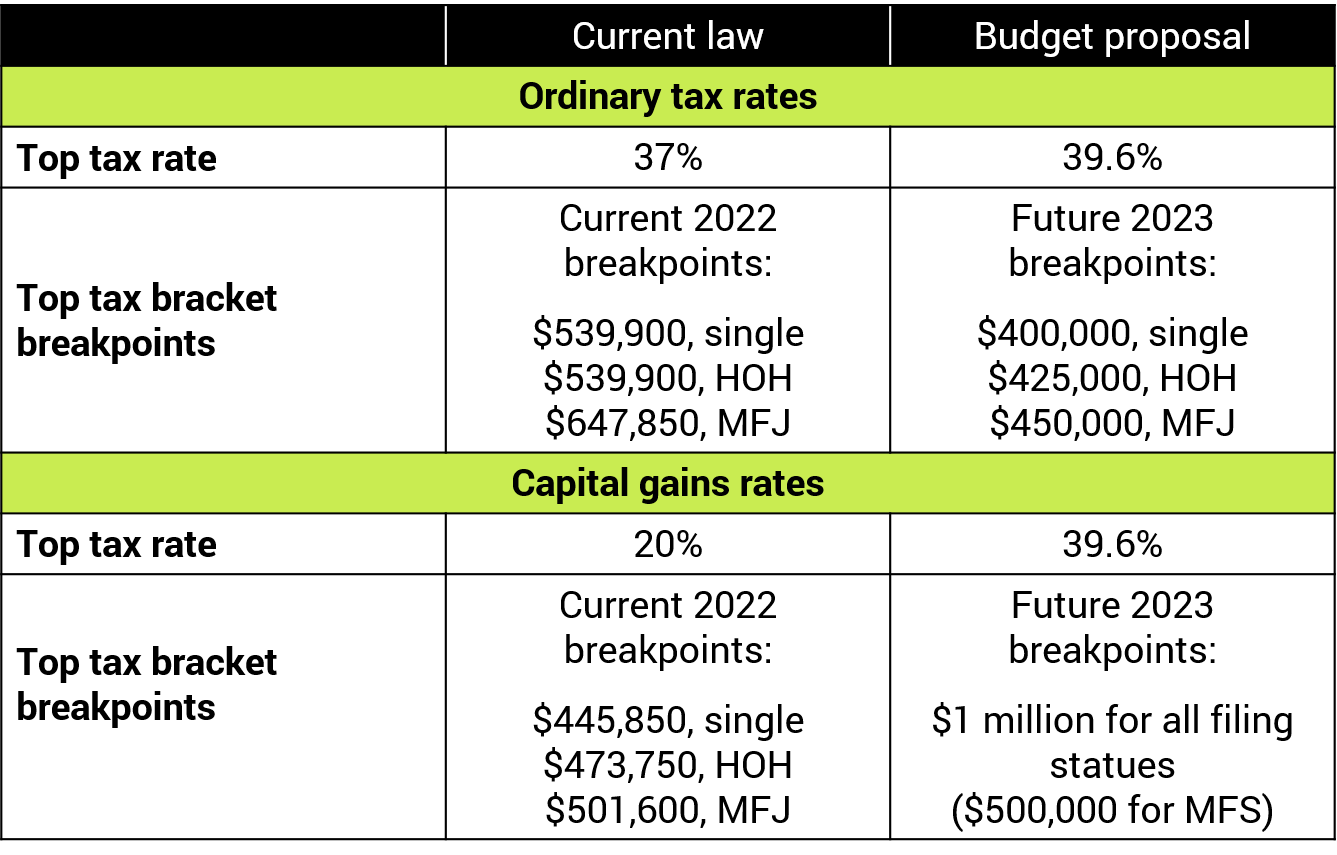

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

2022 2023 Tax Brackets Rates For Each Income Level

Estimated Income Tax Payments For 2023 And 2024 Pay Online

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company

Faytfgmie3qwam

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Social Security Fund Would Be Empty By 2023 If Payroll Taxes Were Cut Actuary Estimates

New York State Enacts Tax Increases In Budget Grant Thornton

Social Security Benefits Could Be Permanently Depleted By 2023 If Payroll Taxes End

Social Security What Is The Wage Base For 2023 Gobankingrates

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

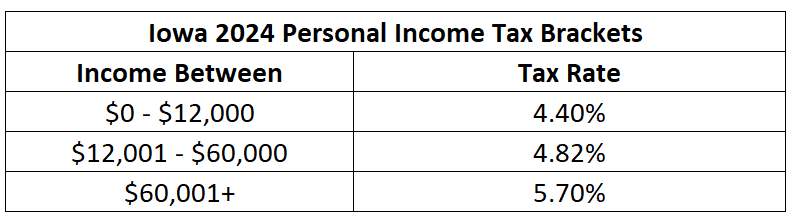

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

President S Budget Proposes 4 6 2023 Federal Pay Raise Fedsmith Com

Tax Year 2023 January December 2023 Plan Your Taxes